Form 1040 Sr 2025. Form 1040 sr is an alternative version of the standard form 1040, tailored to meet the needs of older taxpayers. As soon as new 2025 relevant tax year data has been.

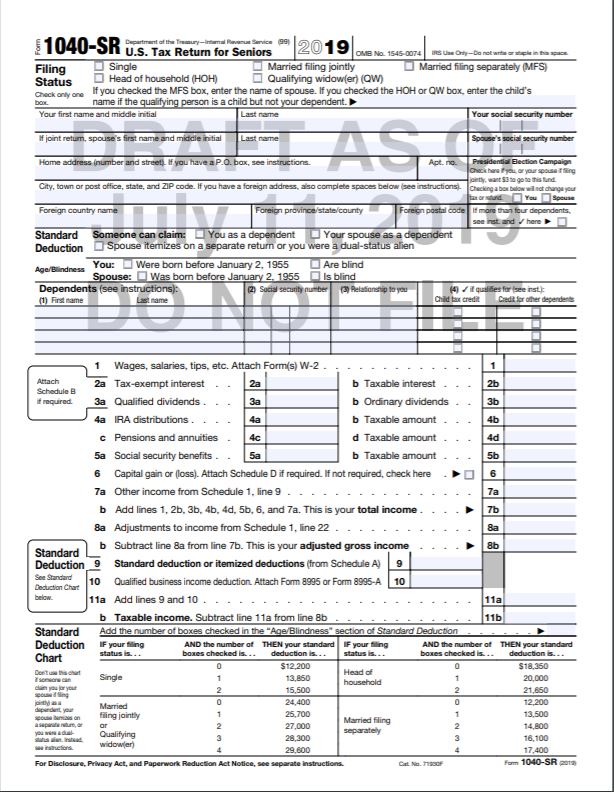

Tax return for seniors) to figure their itemized deductions. Some recent changes to form 1040 mean slightly different filing options available for seniors.

Tax return for seniors, is a specialized tax form designed for individuals aged 65 and older, offering a simplified way for senior citizens to report their.

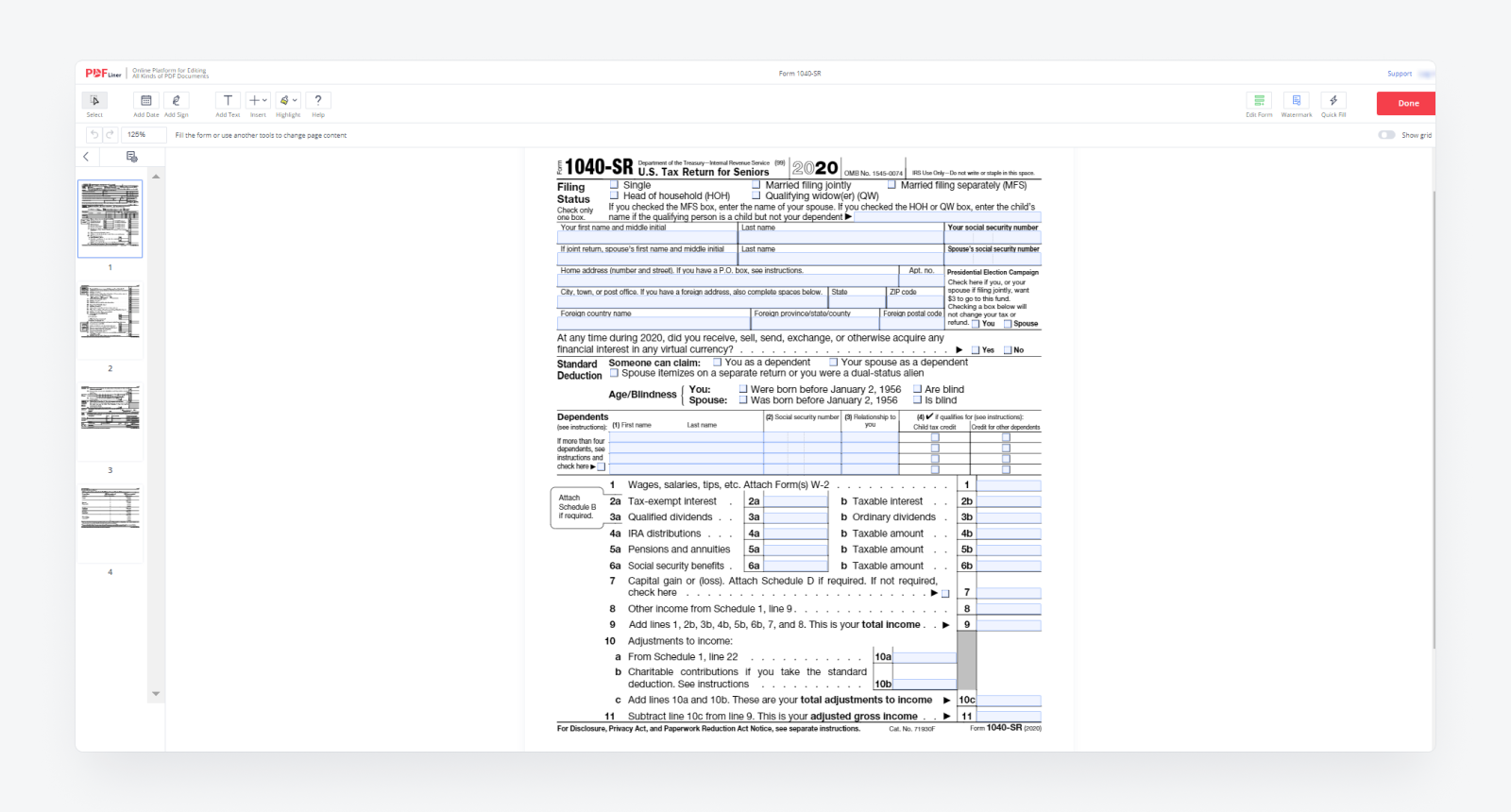

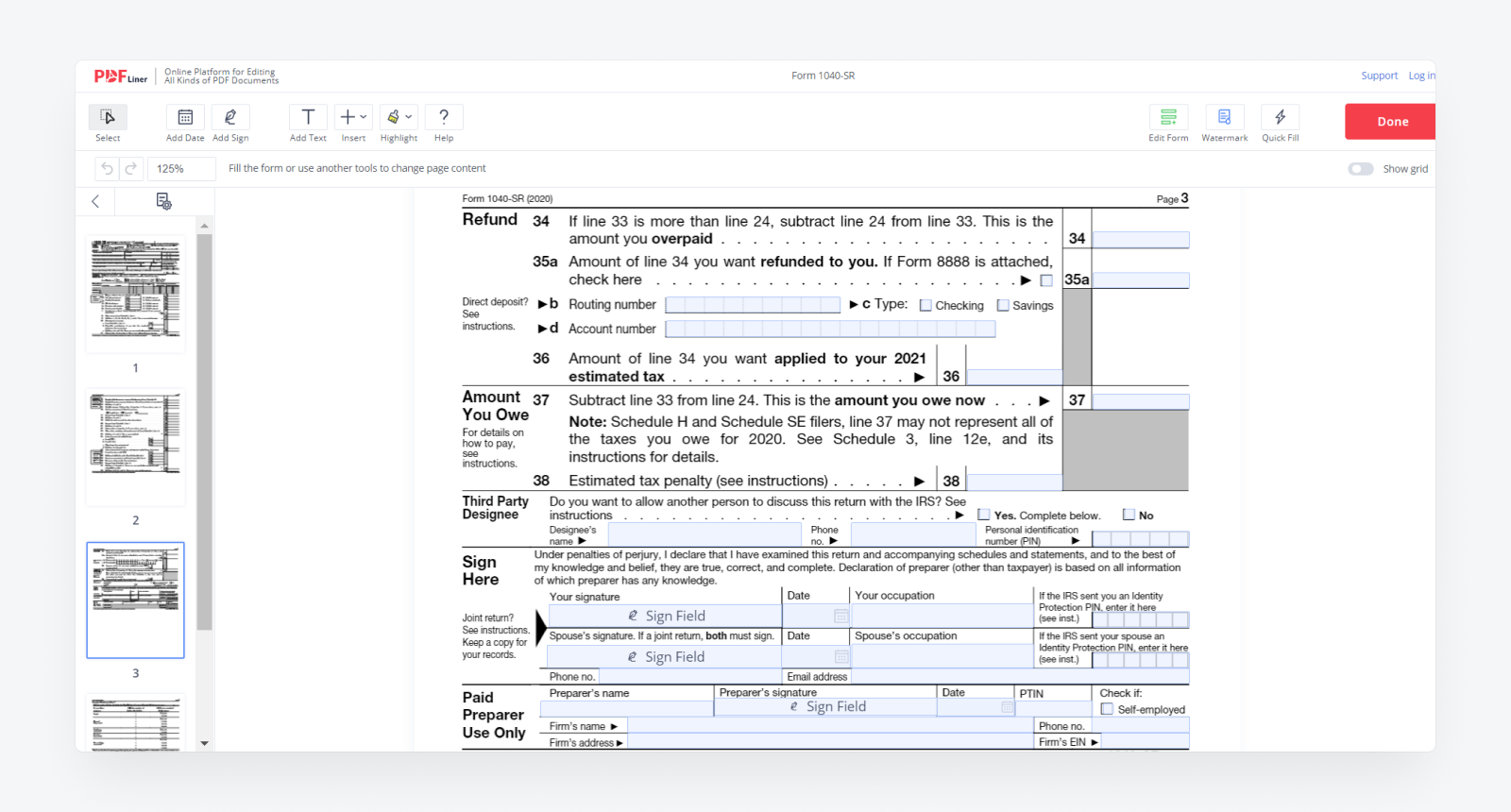

How to Fill Out Form 1040SR Expert Guide, As soon as new 2025 relevant tax year data has been. You can use this form if you are age 65 or older at the end of 2025.

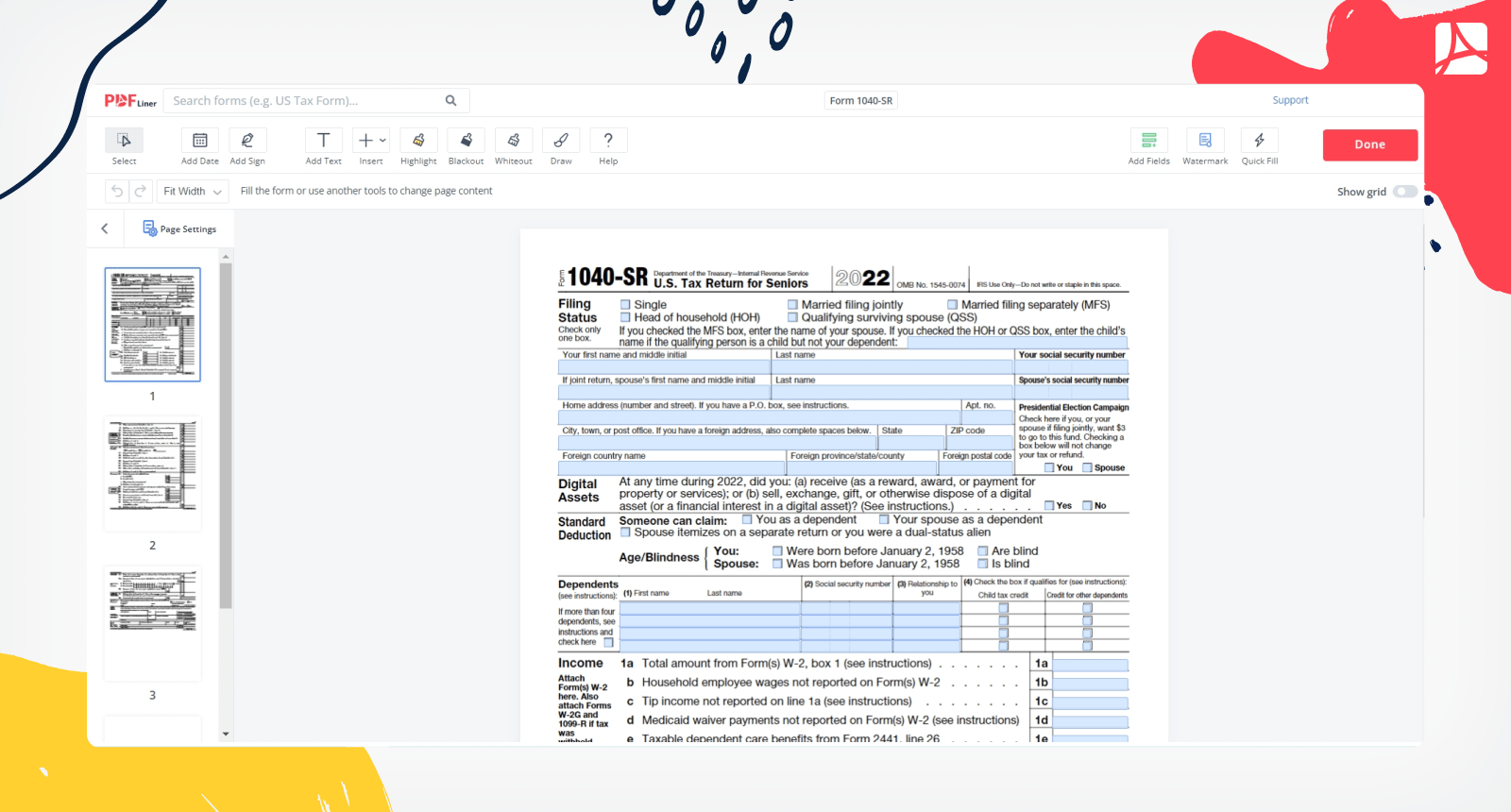

Fillable Online Schedules for Form 1040 and Form 1040SR Fax Email, Enter your filing status, income, deductions and credits and we will estimate your total taxes. Some recent changes to form 1040 mean slightly different filing options available for seniors.

How to Get Form 1040SR for Filling It Easily, The form 1040sr, or senior tax return, is a specialized version of the standard form 1040 designed specifically for taxpayers aged 65 and older. If you prepare your returns by hand, this can.

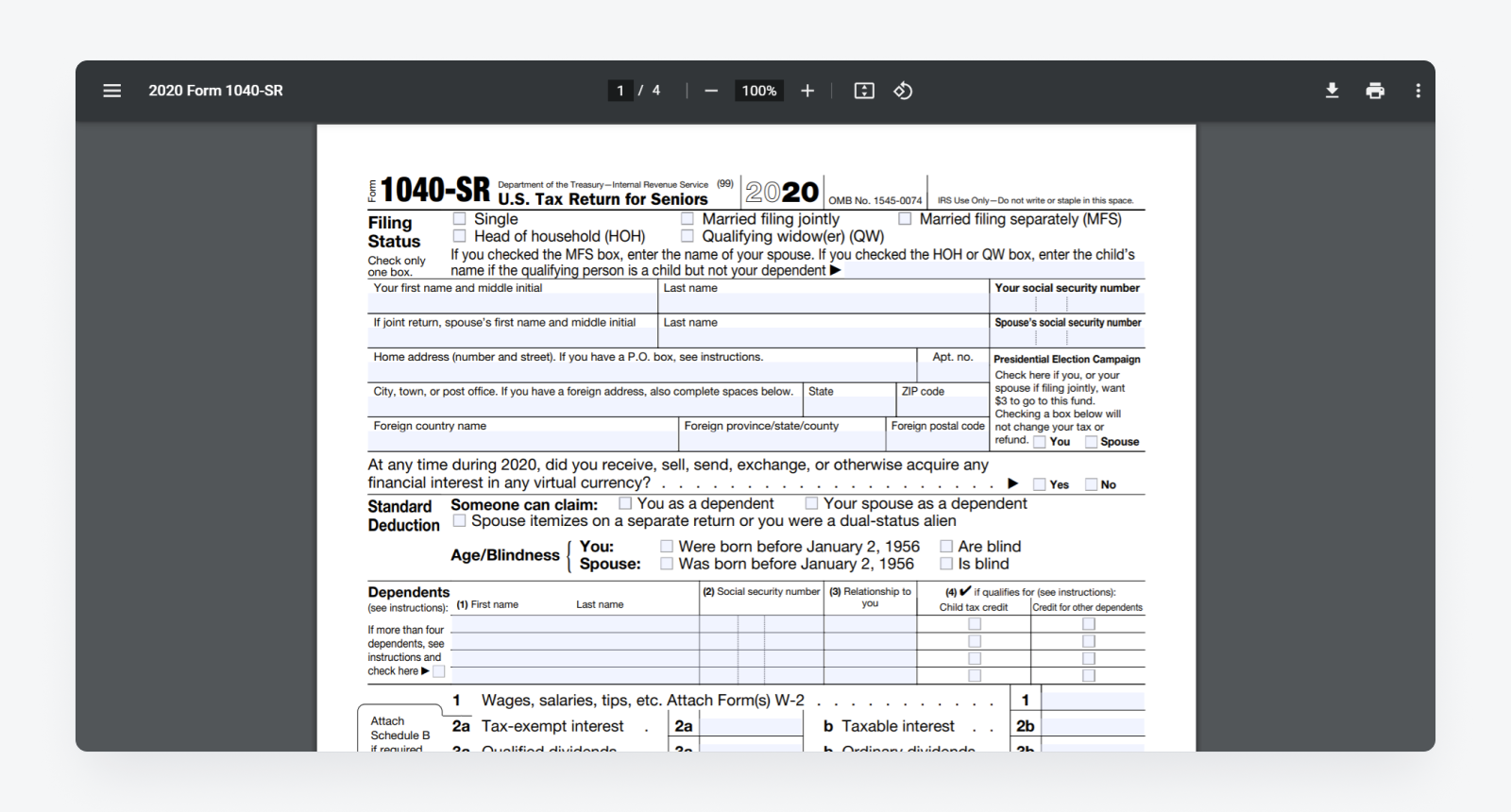

Introducing the IRS Form 1040SR, U.S. Tax Return for Seniors STEVE M, You can use this form if you are age 65 or older at the end of 2025. This form is specifically designed for seniors aged 65 and above, who have simple tax returns and do not need to file any schedules.

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040SR U.S. Tax Return for Seniors Definition and Filing, Enter your filing status, income, deductions and credits and we will estimate your total taxes. Tax return for seniors) to figure their itemized deductions.

How to Get Form 1040SR for Filling It Easily, Tax calculator and estimator for taxes in 2025. If you’ve already filed your 2025 return, submit an amended return using form.

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)

What Is IRS Form 1040SR?, Form 1040 sr is an alternative version of the standard form 1040, tailored to meet the needs of older taxpayers. Tax return for seniors, is a specialized tax form designed for individuals aged 65 and older, offering a simplified way for senior citizens to report their.

How to Sign Form 1040SR Stepbystep Guide, Tax return for seniors) to figure their itemized deductions. The form 1040sr, or senior tax return, is a specialized version of the standard form 1040 designed specifically for taxpayers aged 65 and older.

IRS Form 1040SR Instructions Tax Return For Seniors, The form 1040sr, or senior tax return, is a specialized version of the standard form 1040 designed specifically for taxpayers aged 65 and older. File or amend your return:

IRS Introduces new Form 1040SR designed for seniors The American, Tax calculator and estimator for taxes in 2025. Enter your filing status, income, deductions and credits and we will estimate your total taxes.

The form 1040sr, or senior tax return, is a specialized version of the standard form 1040 designed specifically for taxpayers aged 65 and older.